nassau county property tax rate 2020

However some school districts use different tax rates for different property classes. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Search Any Address 2.

. Nassau County Annual Tax Lien Sale - 2022. Taxes for village or city purposes and for school purposes are billed separately. COVID-19 Nassau County property taxes 145 pm Mon April 20 2020 Long Island Business News David Winzelberg.

How to Challenge Your Assessment. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. What Is the Nassau County Property Tax Rate.

In most school districts the tax rates are the same for all property. Assessment Challenge Forms Instructions. The median property tax also known as real estate tax in Nassau County is 871100 per year based on a median home value of 48790000 and a median effective property tax rate of 179 of property value.

Due to the postponement of last years sale in response to the COVID-19 pandemic this sale will contain unpaid taxes from both 2020 and 2021 tax years. Explore how Nassau County applies its real estate taxes with this thorough review. Nassau County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your property equals your property tax for county town and special district. Nassau County property taxes are assessed based upon location within the county.

I thought it would be easy and I tried to look online for the Nassau county property tax payment. Your individual STAR credit or STAR exemption savings cannot exceed the amount of the school taxes you pay. By comparison the median.

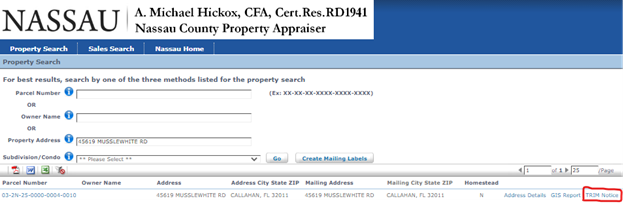

County Nassau County Department of Assessment 516 571-1500 General Information Provides information from the Department of Assessment on rules procedures exemptions and general information. Visit Nassau County Property Appraisers or Nassau County Taxes for more information. See Property Records Tax Titles Owner Info More.

Originally Posted by kathl88. The New York Comptrollers Office in 2017 reported an average effective Nassau County property tax rate of 188. Rules of Procedure PDF Information for Property Owners.

Generally speaking if you live in a school district that uses different tax rates for different property classes you will see the property. Access property records Access real properties. 31 unanimously approved the citys fiscal year 2020-21 budget.

Whether you are already a resident or just considering moving to Nassau County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. For the second year in a row Nassau Bay residents will see a property tax rate decrease after the Nassau Bay City Council on Aug. Whether you are presently living here just considering moving to Nassau County or planning on investing in its property study how district real estate taxes function.

You can pay in person at any of our locations. The RPIA provides a five-year phase in for changes to a homeowners assessed value for the 202021 tax year caused by the countywide reassessment. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales.

Nassau County Tax Collector. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value.

So far Suffolk Countys deadline for its annual property taxes remains May 31. We are moving to Roslyn Estates and elected to pay our property taxes ourselves because our lender resells the loan to a provider that has a bad track record of keeping top of tax payments. Without it about half of Nassau County homeowners whose property assessed values increased may have faced significantly increased tax liability this Fall.

Nassau County New York. Ad Searching Up-To-Date Property Records By County Just Got Easier. Ad Be Your Own Property Detective.

If you would like more information and are interested in learning more about what tax advantages may be applicable to your business please call our office at 904-225-8878. 86130 License Road Suite 3. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

Penalties and other expenses and charges against the property. What is the property tax rate in Nassau County NY. Search For Title Tax Pre-Foreclosure Info Today.

Learn all about Nassau County real estate tax. Long Island property tax is among the countrys highest due to high home prices and high tax rates. Nassau County Tax Lien Sale.

A year later it was 600000 a 143 percent increase. The amount of your 2021 STAR credit or STAR exemption may be less than the amount shown above due to either of the following reasons. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

Across Nassau County residential property values increased by 119 percent in the same time period. The Nassau County Sales Tax is collected by the merchant on all qualifying sales made. In November of 2019 the median pending sale price for a residential condominium or co-op property was 525000.

In 2019 the median Nassau County tax bill was 14872. Fernandina Beach FL 32034. Each years unpaid taxes will be sold separately so for example if a.

Get Record Information From 2022 About Any County Property. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Nassau County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax.

It is also linked to the Countys Geographic Information System GIS to provide.

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

2022 Best Places To Buy A House In Nassau County Ny Niche

Property Taxes In Nassau County Suffolk County

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Receiver Of Taxes Town Of Oyster Bay

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Nassau County Ny Property Tax Search And Records Propertyshark

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

New York Property Tax Calculator Smartasset

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Taxes In Nassau County Suffolk County

Tax Collector For Polk County Service Centers Will Be Closed Monday For Labor Day Polk County Tax Collector

Property Taxes In Nassau County Suffolk County

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation